Upgrading training in the Banking sector

Design perspectives within the context of the German Qualifications Framework

Dr. Monika Hackel

Despite the fact that a high proportion of workers is in possession of a higher education entrance qualification, initial and advanced dual training remains the dominant strategy for training in the German banking sector. Will the branch, however, be able to continue to withstand the generally increasing trend towards academisation? And what options are available in order to be able to maintain the future attractiveness of advanced training structures that have grown traditionally? The present article reflects upon the future shaping of advancement pathways in the banking sector on the basis of data relating to the current and future employment situation in the branch. It also highlights changes to general conditions and opportunities arising as a result of the introduction of the German Qualifications Framework.

Structures in the banking sector

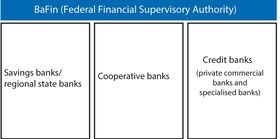

The German banking sector is traditionally divided into three sub-sectors (or “pillars”), which operate under the state umbrella of the German Central Bank and are subject to scrutiny by the Federal Financial Supervisory Authority.

Savings banks/regional state banks, cooperative banks and private commercial banks and specialised banks are each separately organised with their own association structures (cf. Figure 1). These also encompass separate training structures for each kind of bank and continuing training institutes, the so-called “bank academies”. The whole of the value-added chain of the banking sector is processed within these structures, essentially via banking institutes that act as universal banks. In addition, a trend towards specialisation amongst financial institutions has become apparent. Production banks develop products and process transactions for other banking institutes (transaction banks).

Retail banks specialise in direct customer contact, whereas portfolio banks concentrate on the management of market and credit risks for retail and transaction banks (cf. Flesch 2008).

Employment structure and predicted developments – areas of potential and risks

According to the Employee Survey conducted by the Federal Institute for Vocational Educa-tion and Training, BIBB, and the Federal Institute for Occupational Safety and Health, BauA, (BIBB/BauA Employee Survey), almost 62 percent of those employed in the banking sector state that vocational education and training is the highest occupational qualification they have acquired (cf. Frank et al. 2014).

In statistical terms, over 73 percent of banking employees have undergone specific bank or savings bank training. The relevant training occupation in this regard pursuant to the Vocational Training Act (BBiG) is “bank clerk”. The banks mostly recruit young people with good school leaving qualifications who are in possession of a higher education entrance qualification. For this reason, the duration of training is often shortened. Advanced and continuing vocational training has traditionally been very important within the branch. Almost a quarter of bank specialists have a degree-level qualification. One in five of these have obtained such a qualification at a bank academy. In the banking sector, this qualification is as widespread as an advanced training qualification.

The figures illustrate the particular advanced training structures in the banking sector and the parallel presence within the respective pillars of state regulated advanced training pursuant to the BBiG and of bank academy provision.

A forecast of the development of labour demand until 2030 was calculated within the scope of the Federal Institute for Vocational Education and Training (BIBB) and Institute for Employment Research (IAB) qualifications and occupational field projections (cf. Maier et al. 2014). A comparison between the development of the projected requirement for qualified banking and insurance workers with the supply of skilled workers with a relevant qualification shows that demand will fall more rapidly than the labour supply in the period to 2030. By 2030, the difference between the supply and demand will increase to 120,000 qualified banking and insurance workers unable to work in the occupation in which they have trained. This means that increasing numbers of trained skilled workers will be forced to leave the occupation they have learned.

Nevertheless, not all regions will be affected equally. This development will also only occur if the comparatively high relative wage level in the banking industry can be maintained. The extremely high proportion of persons in this training occupation with a higher education entrance qualification means that, in contrast to other training occupations, the sector will benefit from the increase in the numbers of young people with an upper secondary school leaving qualification. The banking industry has little to fear with regard to being able to recruit enough young skilled workers as long as it continues to be viewed as an alternative to higher education study by those in possession of the upper secondary school leaving certificate.

Whether dual training in the banking sector is able to retain its popularity amongst upper secondary leavers ultimately also depends on the attractiveness and transparency of possible advancement routes within the branch. The assumption is that young people will attach greater importance in future to than was the case in the past to the option of being able to move into other attractive fields of work. Aspects such as state recognition and permeability of training qualifications in the banking sector could, therefore, gain in significance in terms of the recruitment of high-ability young people. For this reason, the following analysis of the advanced training system in the banking industry will place a particular emphasis on such aspects.

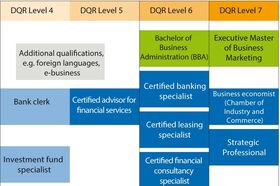

Over the past years, a three-level inter-related model has developed within the system of state regulated advanced training regulations pursuant to § 53 BBiG (cf. the BIBB Board Recommendation of 12 March 2014 and Ressel in the present issue of BWP). In the banking sector, the three-level model of state regulated advanced training has not yet been robustly implemented. For this reason, the following example will describe the reference levels of upgrading training pursuant to the BBiG and their alignment to the German Qualifications Framework (DQR) for the whole of the financial services sector (cf. Figure 2).

The first advanced training level (level 5 of the DQR) provides an opportunity to begin specialist training. These advanced training regulations build on the competences acquired during initial training, supplement these by adding new and more demanding competences and thus open up new fields of employment.

One example of such a state regulated advanced training occupation in the financial services sector is certified advisor for financial services. The starting point for the promulgation of the advanced training regulations for this qualification in 2012 was the increased requirement for competent advice in the insurance sector, an object of broad debate in the wake of the financial crisis. Certified advisors for financial services specialise in financial products aimed at the retail banking sector including financial consulting, real estate, credit finance and insurance. Qualifications at the second level of advanced training provide commercial training for roles such as certified specialist or certified senior clerk. These qualifications fulfil the requirements for functions involving specific specialist and management tasks and are aligned to level 6 of the DQR, the same reference level as a Bachelor degree. The most important banking-specific advanced training regulations pursuant to the BBiG are those leading to the qualification of certified banking specialist.

Alongside general examination areas in business administration, economics and law, this advanced training qualification also encompasses specialisation in the areas of real estate, retail banking or corporate banking. There are also further specific training regulations at certified specialist level such as certified leasing specialist, a qualification which was established pursuant to the BBiG in 1995 with a specific focus on the leasing and real estate leasing sector. The financial services industry also includes other advanced training occupations, such as certified financial consultancy specialist. This represents an extension of the advanced training regulations leading to the qualification of certified advisor for financial services and expands the consultancy aspect to the corporate customer area.

Regulations governing the qualifications of Strategic Professional (IT sector), business economist, technical business economist and certified vocational training specialist are aligned to the third level of advanced training. The examination leading to the qualification of business economist, for example, provides preparation for strategic leadership and management tasks. Contents include marketing management, balance sheet and tax policy, financial management, the general legal conditions governing corporate management and European and international economic relations. The entry requirement is successful completion of advanced training pursuant to the BBiG or a comparable qualification. Qualifications are aligned to level 7 of the DQR, the same level as a Masters degree. Alongside these advanced training qualifications at federal level, there are also chamber regulations pursuant to § 54 BBiG and regulations that are governed by federal state law.

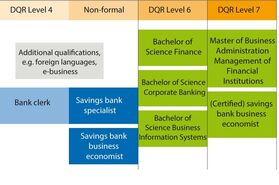

The banking sector has hitherto been dominated by separate continuing training provision aligned to the sectoral sub-structures and thus reflecting the traditional structure of the German banking industry. In principle, each bank is free to choose its own human resources development strategy. Advanced training at the bank academies is traditionally organised along the lines of the respective pillars and tailored to the prevailing regional structures within the catchment area of the academies. Use is also made of other regional continuing training provision and of cooperation agreements with dual institutes of higher education study. The academy-specific training architectures of the banks have different categorisations, as the following example of the savings banks financial group shows (cf. Figure 3).

These deviations relate in particular to savings bank specialists and business economists. Even though the names of these qualifications are based on the state regulations, savings bank certified specialists tend to have a specialist profile in areas such as customer advisory services.

By way of contrast, savings bank business economists within the meaning of the state regulated qualification of bank business economist are found in middle management positions, whereas the former advanced training occupation of certified savings bank business economist, which provided a qualification for strategic leadership tasks, has been replaced by an accredited Masters course of study at the savings bank academy. Alignment to the reference levels of the DQR has, however, not been possible thus far due to the fact that these training courses are not formally state recognised with the exception of a small number of chamber regulations leading to the qualification of savings bank specialist pursuant to §54 BBiG. Training architectures of the bank academies are certainly based on extensive coordination processes with the regional bank institutes and a differentiated determination of requirements, and orientation towards competence models is also revealed (cf. e.g. Haase/Ringwald 2012; Schax 2008). Opportunities for credit transfer to the accredited courses of study at the academies means that there is also a certain degree of permeability within the individual pillars.

If, however, we consider the training architecture against the background of the prognoses and requirements listed above, then areas where improvements are needed become apparent. Recognition across branch borders and within an international context is not, for example, consistently in place. Neither are the current areas of potential of a harmonised initial and advanced training system being fully exploited. For this reason, two possible structural options for a more transparent and more permeable organisation of advanced training in the banking sector will be illustrated below. These could serve as a starting point for dialogue between the social partners.

Possible structural options for the future of advanced training in the banking sector

The joint resolution on the DQR adopted on 1 May 2013 by the Standing Conference of the Ministers of Education and Cultural Affairs (KMK), the Federal Ministry of Education and Re-search (BMBF), the Conference of the Ministers of Economic Affairs and the Federal Ministry of Economics and Technology (BMWi) agreed to expand the DQR over the coming years to include other areas of learning (non-formal, informal) in line with the recommendations of the European Commission. In 2013, two separate working groups were set up to address the question of how competences acquired in non-formal or informal learning contexts can be aligned to the DQR. Agreement has so far been reached with regard to supporting an alignment of non-formal learning qualifications to the DQR on the basis of clear requirements, criteria and procedures (cf. Expert Group DQR 2013). Further work will involve using the evaluation of specific examples from the field of non-formal learning as a vehicle for clarifying whether these are qualifications within the meaning of the DQR and can be aligned to a DQR reference level. These examples can be determined as so-called anchor qualifications for certain areas. An examination and alignment of the advanced training provision of the bank academies would be apposite in this regard. This will direct attention to a systematic and permeable structuring of upgrading training to a greater degree than has previously been the case. Two development perspectives are conceivable for the further profiling of this area with regard to transparency, permeability and not least comparability of qualifications within the European Education Area.

Firstly, an examination of the training courses at the bank academies within the scope of alignment of qualifications from the area of non-formal learning could make the quality of this transmission transparent and enable certification to take place. Such a route would, however, necessitate the investigation and alignment of the various provision.

Secondly, stakeholders could also use the debate surrounding the DQR in order to draw up a joint training architecture within the state regulated system that extends across the different pillars. Initial and advanced training regulations are currently being developed and enacted in a way that is independent in terms of schedule and content. It is presently not possible to em-brace the option of providing credit transfer to subsequent advanced training courses of parts of vocational education and training, e.g. additional qualifications completed during VET and recognised via an examination. This would create incentives for high-ability trainees in particular. Permeable structuring and recognition of learning achievements in both directions and across all levels of advanced training including higher education study would also facilitate alternative development pathways for higher education dropouts, for example, and make it possible to recognise learning outcomes achieved if trainees switch to other commercial training routes. A more robust orientation and more systematic implementation of a staged three-level training architecture as recommended by the BIBB Board (2014) would assist with quality assurance, create transparency and acceptance for dual initial and advanced training and offer space for a permeable structure with credit transfer opportunities. The protection offered by state regulated structures could be used to develop transparent training provision that is aligned towards state recognition and that also demonstrates its attractiveness to upper secondary school leavers by opening up clear and permeable development pathways. The starting point here would be a robust competence oriented structuring of the dual training occupation to serve as the basis for three-level advanced training that is aligned towards the requirements of the branch.

Literature

BIBB Hauptausschuss [BIBB Board]: Eckpunkte zur Struktur und Qualitätssicherung der Beruflichen Fortbildung nach Berufsbildungsgesetz (BBiG) und Handwerksordnung (HwO) [Benchmarks for the structure and quality assurance of advanced vocational training pursuant to the Vocational Training Act (BBiG) and the Crafts and Trades Regulation Code (HwO)]. Recommendation of 12 March 2014 – URL www.bibb.de/dokumente/pdf/HA159.pdf (Status: 02.06.2014)

Expertengruppe DQR [Expert Group DQR]: Entwurf: Expertenarbeitsgruppe zur Zuordnung von Ergebnissen nicht-formalen Lernens im Deutschen Qualifikationsrahmen, Abschlussbericht [Draft: Expert Working Group on the alignment of the results of non-formal learning in the German Qualifications Framework] Status: 26.11.2013 (as yet unpublished 2013)

Flesch, J. R.: Die Zerlegung der Wertschöpfungskette als Treiber für den Umbau der Bankenbranche [The dismantlement of the value-added chain as a driver for restructuring in the banking sector]. In: Spath, D.; Bauer, W.; Engstler, M. (Eds.): Innovationen und Konzepte für die Bank der Zukunft [Innovations and concepts for the bank of the future]. Wiesbaden 2008, pp. 199–207

Frank, I. et al.: Entwicklungen und Perspektiven von Qualifikation und Beschäftigung im Bankensektor [Developments and perspectives of qualification and emplyoment in the banking sector]. A special analysis conducted by BIBB. Bonn 2014 (being printed)

Haase, D.; Ringwald, A.: Fachkräftesicherung in der Sparkassen-Finanzgruppe. Bildungsangebote müssen flexibel und bedarfsgerecht sein [Securing a supply of skilled workers in the savings banks financial group. Training provision needs to be flexible and in line with requirements]. In: Betriebswirtschaftliche Blätter [Business Administration Papers], 2 (2012), pp. 66–69

Maier, T. u.a.: Shortages in the medium qualifications area despite increased immigration. BIBB-Report 23/2014. Bonn 2014

Schax, E.: Strategieorientierte Personalentwicklung in Genossenschaftsbanken.

Eine empirische Untersuchung zur betrieblichen Weiterbildung [Strategy oriented human resources development at cooperative banks. An empirical investigation of company-based continuing training]. Wiesbaden 2008

DR. MONIKA HACKEL,

Research associate in the "Commercial, Media and Logistics Occupations" Division at BIBB

Translation from the German original (published in BWP 4/2014): Martin Stuart Kelsey, Global Sprachteam Berlin